Old-Fashioned Wisdom for Unprecedented Times

If you’ve been following the news, you likely feel as if you’ve been on a roller coaster since March. Are we in a first wave or a second wave? Is the economy reopening or closing back up? Is the surge in the markets justified, or are we locked in a cycle of irrational exuberance, quickly followed by despair?

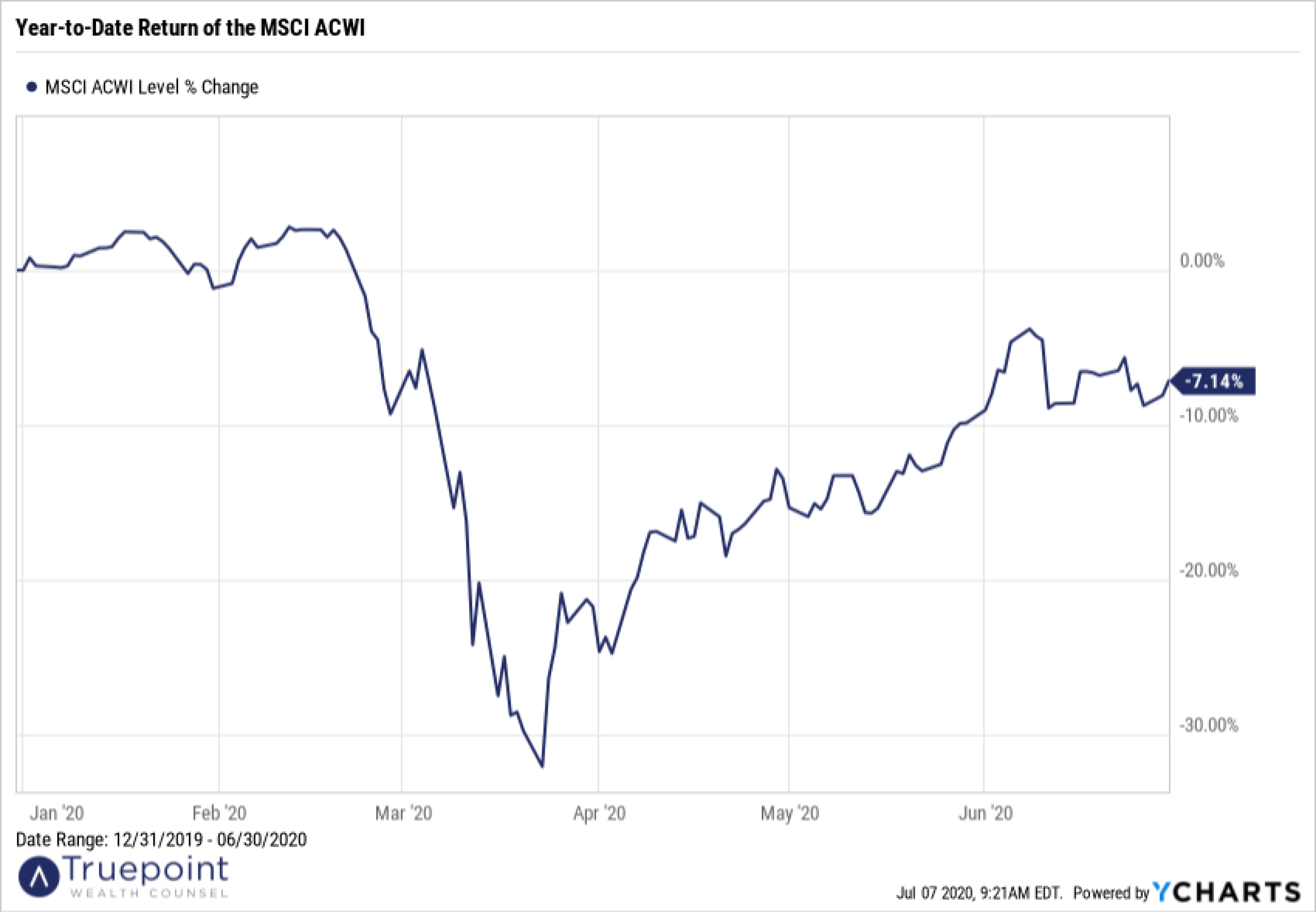

Investors can be excused for feeling uncertain. After a dramatic drop in March, markets rallied in April. The MSCI ACWI (All Country World Index), a measure of the global stock market, returned 10.6% for the month. Strong returns continued in May, and by early June, the MSCI ACWI had nearly made up all its losses for the year. Then, in the second half of June, volatility had unmistakably returned, tied to the vacillating reports about the COVID-19 outbreak, particularly in the U.S. Despite the return to volatility in June, the MSCI ACWI had one of its strongest quarters since the inception of the index in 1990, rising 18.7% in just three months.

Disclaimer: It is not possible to invest directly in an index.As we have touched on in prior posts, investors seem focused on three things: the rate of COVID-19 case growth, the policy response, and the potential for a strong rebound in corporate profits over the coming 18 months. When viewed this way, the ongoing stock rally begins to make a bit more sense.

Though the pandemic itself is not a short-term issue, the situation is dynamic and shifting often. The economy is re-opening bit by bit, and while measured infection rates are increasing, hopefully that means the susceptible population will be decreasing over time. At this point, it’s reasonable to assume the market has baked in the inevitability of significant disease transmission, with sporadic spikes to be expected.

The monetary policy response from the Federal Reserve (Fed) points to rates remaining near zero through 2022. In addition, the Fed will continue with their asset purchase program to push more money into the economy. On the fiscal side, there is a clear expectation that the government will take additional action; it will likely extend unemployment benefits through the end of the year and, preliminary reports suggest that, an infrastructure package is also being discussed. Furthermore, U.S. consumers’ disposable income remains high, and they seem, overall, primed for spending, as evidenced by the record increase in retail spending from April to May this year. However, a resumption of a normal economy will have to await the widespread distribution of a vaccine, hopefully in early 2021.

How to Capitalize on Market Volatility

While difficult to control our emotional response to these ups and downs, there are other things we can control. Truepoint clients who have looked at their statements won’t be surprised to see that we have been taking heavy action in our clients’ portfolios during this time. After stocks were up more than 30% in 2019, we were selling some stocks to buy more bonds. Then, after stocks dropped more than 30% in February and March, we were selling some bonds to buy more stocks. Now that stocks have risen over 30%, you get the picture (literally, there is a picture of the process below). This is how we manage portfolios in all times, but in periods of high volatility, the constant drifting away from allocation targets results in heavier trading.

In addition, for clients with taxable accounts, it’s likely there have been tax-loss harvesting trades placed in your portfolio. Tax-loss harvesting involves selling a security in a taxable account and realizing a loss. By realizing, or “harvesting” a loss, you can use the loss to offset taxes on both realized capital gains and up to $3,000 of ordinary income. Most importantly, the security that is sold is immediately replaced, which keeps your portfolio exposure intact, so you will fully participate in the market recovery. Any losses at the end of the tax year which exceeded gains will carry forward to future tax years until they are all offset by realized capital gains and ordinary income.

Both rebalancing and tax-loss harvesting are important strategies we employ in up and down markets. And we’ve mentioned these frequently in the investment focused Truepoint Talks webinars over the past few months. On July 14, our Truepoint Talks webinar will take a closer look at both, through a client case study.

What Can We Learn From the Downturn?

The current environment demonstrates the truth of the old investment adage: “the market is not the economy.” It can seem counterintuitive that the two could move in opposite directions, but historically markets routinely anticipate economic changes. That’s because markets are forward looking, focused on corporate earnings well beyond the next quarter. Analysts, portfolio managers, and financial professionals regularly sift through economic reports, consult sophisticated modeling, and forecast possible valuations years into the future, so that markets tend to reflect current, consensus estimates of future corporate earnings. Of course, unexpected events (like a pandemic) can occur, and when they do, markets can sell off very quickly, as they did in March. During these downturns, some investors rush to sell off their holdings either out of fear that the downturn will intensify or due to a short-term need for cash. Unfortunately, this sell off usually begins too late—after the larger market downturn is well underway. At that point, these investors have missed their chance to “sell high” and are simply reacting to headlines rather than executing a coherent plan.

And thus, another truism fits this moment: “The only thing I know is that I know nothing.” No one predicted a global pandemic would spark a sudden downturn, and similarly, no one predicted that a subsequent rally would mostly erase that downturn within mere months. We certainly didn’t. But we did remind our clients to stay the course because you can never be sure what will happen. By staying the course through the downturn and actively rebalancing portfolios our clients were able to participate fully in this quarter’s upswing, demonstrating that a rational approach to investing will generate rewards for those patient enough to endure it.

The recent downturn contains another valuable lesson for investors. Downturns can become more intense because investors who need cash sell off their holdings at the wrong time. They do not have the savings on hand or proper portfolio allocation to endure a recession, which can last six months or longer. Truepoint’s approach ensures that our clients will not find themselves in this predicament. We craft a comprehensive, personalized financial plan for each client, one that is tailored to achieve their specific long-term goals. Shoring up enough savings and setting an appropriate asset allocation are critical aspects of this plan. Our goal is that no Truepoint client will ever have to worry about whether they have a large enough cash and bond runway to withstand a downturn, so we focus on risk and savings every step of the way.

As we have discussed in our many webinars since this crisis began, we urge you to resist the very understandable temptation to “act fast now” —to do something, anything, amidst uncertainty. Truepoint clients should feel reassured that we are, in fact, doing something—we’re rebalancing your account and we’re tax-loss harvesting (if applicable). These actions not only help protect you from permanent loss, they help you benefit when markets subsequently turn around. These are the planned responses of rational investors, not the heady reactions of those chasing headlines.