A Summary of the Frank Duke Method

In this fifth and final installment in our series on the Duke Method, we offer a brief summary of the approach and its considerations as we have presented over the past year. Keep in mind that the Duke Method is a very complex strategy which requires extra scrutiny before employing.

What is the Frank Duke Method?

Simply put, the Frank Duke Method is a tax-efficient way to distribute funds from the P&G Profit Sharing Trust and Savings Plan after separation from P&G. The big selling point: If you administer the Duke Method correctly, you can avoid up-front ordinary income tax when you move P&G shares from your retirement account to an outside brokerage account.

The Duke Method is the result of two private letter rulings issued by the IRS which approved certain divestment strategies. As we explained in Part I of the series, private letter rulings only apply to one specific taxpayer’s particular set of facts. Nevertheless, many practitioners often view private letter rulings as an indication of the IRS’s position on a certain issue and as a basis for making decisions.

How does the Duke Method work?

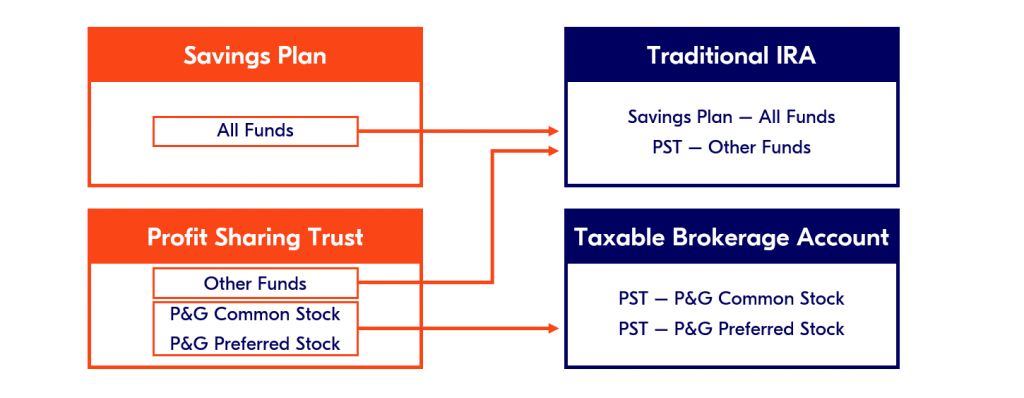

First, the account owner makes a split Qualified Split Lump Sum Distribution – which means that they rollover all of their Savings Plan assets to a traditional IRA, and they split their Profit Sharing Trust assets, putting all of the P&G shares into a taxable account and the remaining assets into the traditional IRA.

For the second step, they make another transfer, a 60-day rollover, in which they move some of their P&G shares out of their taxable account and into their traditional IRA. How many shares exactly? Check out Part II of this series to learn how this amount is calculated.

How does the Duke Method reduce your tax liability?

Without the Duke Method, a Qualified Lump Sum Distribution would cause an immediate tax event. The P&G stock that goes into the taxable account would be taxed, since it’s no longer held in a retirement account.

What Frank Duke discovered through his private letter ruling, is that if some of the P&G stock is transferred from the taxable account to the IRA within 60 days, that transfer will offset the taxable income. Therefore, the Qualified Lump Sum Distribution would be seen as a non-taxable event and the account owner would avoid any ordinary income tax obligation on the P&G shares during the year of the distribution.

What should you consider before using the Duke Method?

In Part III of this series, we explained that the Duke Method is not appropriate for everyone. When determining if it makes sense for you, it’s important to also consider your:

- Concentration risk

- Specific tax situation

- Other sources of income

- Emotional discipline

- Future tax rates

To determine whether it is the best approach for you requires an in-depth understanding of each of these items.

Are there alternatives to the Duke Method?

There are other distribution strategies that can make sense for P&G retirees. For example, it is possible to reduce and potentially offset the tax cost associated with the Qualified Lump Sum Distribution by donating some of the P&G shares to charity. Donors can even accelerate future charitable donations into the current tax year through the use of a donor-advised fund.

What are the estate planning implications of the Duke Method?

The Duke Method will impact the amount of assets held in your traditional IRA vs. your taxable brokerage account. As we discussed in Part IV of the series, each account type has its own benefits and drawbacks. While the brokerage account can be owned by a trust, it does not afford the same bankruptcy, creditor, and civil lawsuit protections as an IRA. On the other hand, brokerage accounts give beneficiaries more time to withdraw their assets, whereas IRAs must be withdrawn within 10 years.

In Conclusion: The Duke Method Requires a Coordinated Approach

The Duke Method offers a range of potential advantages, but it also has material downsides—such as capital gains tax, concentration risk, and the threat of an audit. That’s why your advisor needs to know more than just how to execute the strategy. At Truepoint, we have specialist teams devoted to every area of personal finance who work together to analyze your complete financial life and determine the appropriate approach for your unique situation.

In our Frank Duke Method Series:

- Part 1: Understanding the Frank Duke Method

- Part II: Distribution Framework

- Part III: Financial & Investment Management Factors

- Part IV: Income & Estate Tax Factors

- Part V: A Summary of the Frank Duke Method