How to Generate Income in Retirement

When considering retiring from P&G, you may be wondering “how will I generate income to cover my expenses in retirement?” or “where will my monthly paycheck come from?” And, consequently, you will need to decide how to handle the assets held in your PST and Savings Plan. Many people plan to simply roll their retirement accounts into an IRA and live off that.

Yet, if—like many P&Gers—you retire before age 59.5, you can’t access the funds in your IRA without paying a penalty. In addition, you are still many years away from receiving your Social Security benefits. Therefore, you will need to create a bridge to get you from your P&G retirement through to Social Security, at least.

Although everyone’s situation is different, there are some general guidelines that will help you construct a reliable and tax-effective bridge to fund your retirement years. The main guideline you should follow is to first use funds that you have already paid ordinary income taxes on.

This means that you should draw upon your sources of funding in the following order:

- Current income

- Restricted Stock Units (RSUs) and exercised stock options

- Investment portfolio

Using Your Current Income to Cover Expenses

Often, people who retire early from P&G choose to continue working in some form, usually via consulting. If you choose this route to generate income in retirement, then you should use these earnings to cover as much of your expenses as possible each year. That’s because you’re already paying income tax on these funds. Rather than converting any investments into cash and incurring additional tax, always use your earned income first.

How RSUs and Options Fit into Your Income Strategy

If you choose not to work or if your earned income does not fully cover your expenses, the next source you should draw from, if you’ve accumulated these potential sources, is any RSUs that have vested or any options that you’ve exercised. A previous Viewpoint explains our approach to exercising options.

RSUs

When RSUs vest, you will incur ordinary income tax on the value of the grant. We typically advise our clients to sell the shares from their RSUs right after they vest because if you hold onto these shares past the vesting date, you can end up incurring short-term capital gains or losses on the shares.

Options

Unlike RSUs—which incur income tax as soon as they vest—you don’t pay taxes on options until you exercise them. You have a long runway—seven years to be exact—from the time your options vest and your deadline for exercising them. Although the tax rules are different with options and RSUs, the same general principle applies: whenever you have to pay taxes on the options (i.e., when you exercise them), then you should use the funds from the sale to cover your expenses. Keep in mind with options, though, that when the stock is doing very well, you may decide to exercise many of your options at once, or in the same tax year. In that case, you could end up with a windfall, and you should not keep all those proceeds in cash. If your proceeds exceed your living expenses for a given year, you may consider reinvesting the excess funds into your investment portfolio.

How to Set Up Your Investment Portfolio for Flexibility in Retirement

Diversify Your Account Types

Many people transfer their PST and Savings Plan into a rollover IRA in order to avoid immediate tax costs. However, you may be missing out on some valuable benefits if you move all your P&G retirement assets directly into an IRA.

Depending on your situation, you may want to transfer your P&G preferred shares you’ve accumulated in your PST into a taxable (brokerage) account instead of in an IRA. Because of how the IRS treats your preferred stock, you only pay income tax on the cost basis of these shares, rather than on the full amount of their current value, like a typical IRA withdrawal. Instead, you will only pay the long-term capital gain tax rate—not the higher income tax rate—on the appreciation of those shares. This is referred to as the Net Unrealized Appreciation, or NUA. This can significantly reduce your tax bill, but you must put these shares in a taxable account, not an IRA, to qualify. It is important to note here, though, that this option is only available to do, without penalty, if you retire at age 55 or older. Prior to age 55, you incur a 10% penalty on the cost basis of the shares, in addition to the income tax.

Transferring the preferred shares into a taxable account will give you account type diversification, which provides flexibility on where you can pull assets from in retirement to cover your expenses. Thus, you will then have access to an investment account that will not charge any penalties for early withdrawals like an IRA. Holding assets in a range of account types will enable you to take advantage of the different tax treatment that diverse account types offer, allowing you to minimize overall taxes paid in a year and to get the highest after-tax return on your overall portfolio. There are other special considerations when it comes to preferred shares and taxes. To learn more about how to minimize taxes on your preferred shares—and our thoughts on what is popularly known as the Frank Duke method—check out our series on that approach.

Diversify Your Holdings

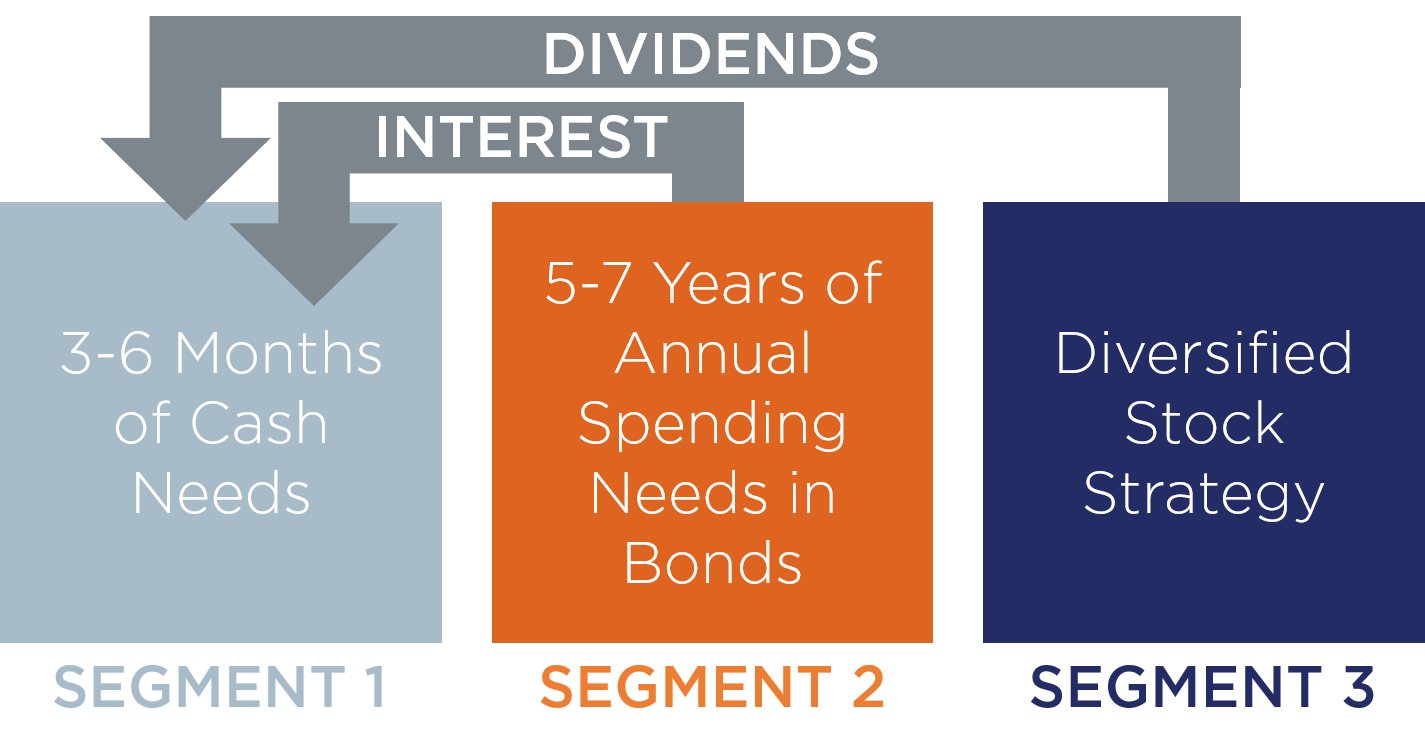

We advise our clients to allocate the stock and bond mix of their investment portfolio based on their annual spending needs in retirement. This helps to provide a quantitative method for determining how much of your portfolio should be in stocks. We begin by calculating a client’s specific spending needs and then use that number to construct a portfolio that consists of three segments:

Segment 1: Three to six months of spending needs in cash. This cash amount is different from the cash a client might be holding on their own, such as in an emergency fund or a savings account. This allocation is kept within the portfolio itself and is intended to fund any expenses the client faces in the short-term.

Segment 2: At least five to seven years of spending needs in bonds. The bond allocation protects our clients in retirement, who are using their portfolio for spending needs, from a stock market downturn. We never want to sell stocks when the stock market is down. Instead, we want to hold enough bonds so that we can be patient and wait to sell stocks when they’ve recovered and, instead, draw from the bond side of the portfolio if the client needs cash. Historical data shows that the average bear market lasts approximately 22 months, so by holding five to seven years of spending needs in bonds, our clients will have ample cushion to fund their needs. Based on a client’s risk tolerance, we may opt to be more conservative than this, but we will not be more aggressive than this (by holding less in bonds), unless there are unique client circumstances that would allow for it. Another benefit of this segment of the portfolio is that bonds generate interest, which we can then transfer to the cash portion of the portfolio (segment 1), as illustrated in the graphic above. Thus, the interest provides additional funds for the client’s current needs.

Segment 3: A diversified stock strategy. The rest of the client’s assets will be diversified across the stock market. You can take greater risks with this segment of the portfolio because segment 1 and segment 2 provide the necessary buffer to withstand a stock market downturn. Maintaining diversified allocations within the stock portfolio also helps ensure that you are always able to raise cash from whichever area of the stock market is generating the strongest return, should it be an opportune time to trim from the stock side of the portfolio to cover cash needs. In other words, you can make sure you are always in the position to buy low and sell high—one of the critical strategies for generating robust investment returns. Additionally, these stocks pay dividends, which—like the interest earned on bonds—will generate income taxes, so we will transfer those proceeds into segment 1 as a source for current living expenses.

Here we have explained some overarching principles on how to use your P&G retirement accounts and investment savings to fund your retirement. As you can see, though, these principles should be adapted to your specific situation—your individual spending needs, your tax situation, your family situation, the breakdown of your P&G assets—as well as your hopes and dreams for retirement.

At Truepoint, we understand that each client is unique, even if they share similarities, such as working for the same company. To create a comprehensive plan for each client, we bring together a team of experts—in tax, estate planning, financial planning, and investing—that will help them achieve their goals. This is not a “set it and forget it” approach, but a dynamic process that changes with you.