Proceed With Confidence: Diversification at Work

As you review your portfolio’s 2014 performance, you’ll notice it was a more modest year compared to the double-digit returns enjoyed in 2013. Coincidentally, the 2014 return landed quite close to the average annual return we would expect to see long term – the same figure we incorporate in financial planning projections. But while the return may be average, the year was far from normal:

- Volatility, and investor jitters, returned. Investors weathered the surprises that 2014 brought, from the unrest in the Middle East that caused oil prices to temporarily spike in June, the outbreak of Ebola that shook markets in October, and now the glut of oil that has caused crude prices to plummet.

- What happened to the “sure things?” With the Federal Reserve winding down their bond-buying program, what was predicted to be a “sure thing” for 2014 – an increase in interest rates and inflation – never did occur. Interest rates in fact fell further, and bonds, especially longer dated issues, were positive contributors to portfolio returns.

- Divergent asset class returns. The average overall return masks the wide-ranging performance among the underlying asset classes. U.S. real estate posted returns in excess of 30%, U.S. stocks finished the year over 10%, while foreign stocks ended the year in negative territory.

While such a wide gap in asset class performance can frustrate investors, it is the hallmark of a well-diversified portfolio. In other words, being truly diversified means that we should expect to be disappointed in at least one asset class every year.

This year the disappointment for investors was undoubtedly foreign markets, and given this, we thought it timely to take a closer look at this asset class and revisit the role it plays in your portfolio.

Five Benefits of Investing in Foreign Markets

If you’re hesitant to invest abroad, you’re not alone. That’s especially true when the U.S. market is outperforming. But while many investors shy away from the unfamiliar, there are many compelling reasons for keeping the big, global picture in mind. The following are five such reasons.

1. Twice the Opportunity

The U.S. stock market represents just 50% of the publically investable stocks worldwide. So while it may feel safer to invest in companies close to home, you risk missing out on half of global investment opportunities.

The upside becomes clearer with a look at blue-chip stocks. In Forbes’ recent list of the world’s largest companies, only 11 of the top 25 were U.S.-based. That means without foreign exposure in your portfolio, you would be missing out on some of the most successful companies on the planet, including:

- Nestle, the largest food company in the world

- Novartis, the largest pharmaceutical company in the world

- Toyota, one of the world’s largest car companies

- Samsung, the world’s largest smartphone maker

2. A Smoother Ride

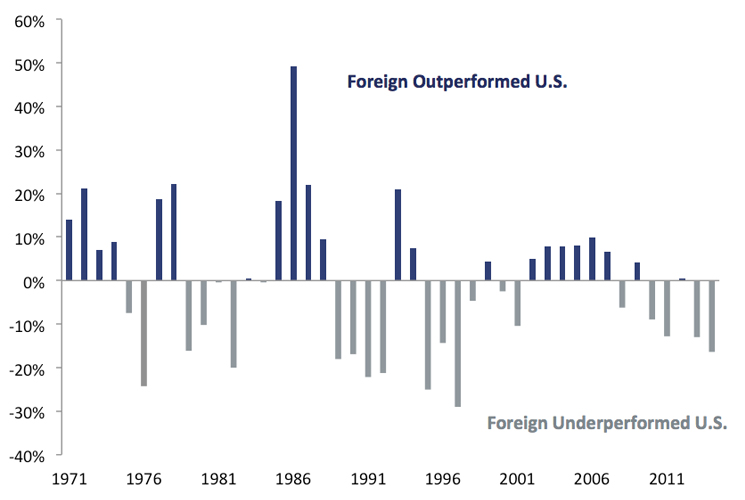

While performance this year has lagged domestic returns, foreign markets have historically produced comparable returns. The chart nearby depicts the annual returns of foreign developed market stocks minus the returns of U.S. stocks from 1971-2014. The big idea is that exactly half the time, foreign stocks have outperformed their domestic counterparts.

More importantly, foreign stocks often perform very differently than U.S. stocks in any given year. The difference between foreign and domestic returns has been at least 10% more than half of the time. This means that while long-term returns are similar, shorter-term disparities allow well-diversified investors to smooth out the extremes that can arise from investing in a single market. These timing differences also provide great opportunities to sell high and buy low – the natural outcome of adhering to a disciplined rebalancing process.

3. Additional Diversification from Currencies

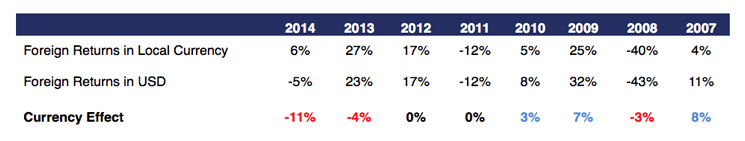

Because the U.S. dollar strengthened in 2014, foreign stock returns were reduced when translated from their local currencies into the dollar. In fact, foreign stocks have not performed poorly if you look at their returns in local terms. You can see this if you compare the local return of the MSCI EAFE Index to the Index’s U.S. dollar return. The Index, which tracks stocks of developed foreign markets, was up nearly 6% in local currency terms, but down 5% in U.S. dollar terms; in other words, translation back into the U.S. dollar had a -11% drag on returns for the year.

History suggests that the impact of currency translation should be largely neutral over the long term, as shown in the table below. While in 2014, 2013 and 2008 translation back into the U.S. dollar detracted from performance, it helped U.S. investors in 2010, 2009 and 2007.

While currency movements don’t necessarily affect long-term returns, they benefit the portfolio because currencies tend to move differently than stock prices, which adds yet another element of diversification.

4. Value Appeal

While the media repeatedly debates whether the U.S. market is overvalued, little attention has been paid to the valuation of foreign markets. In fact, foreign markets look quite attractive: consider that the MSCI EAFE Index is currently 20% below its peak level, reached in 2007. In contrast, the U.S. market has already exceeded its pre-financial-crisis peak. We know that valuations are an unreliable way to time markets in the near-term. They are, however, a good predictor of long-term returns – meaning that foreign stocks will appeal to forward-looking long-term investors heading into 2015.

5. Reduces Overall Risk

Foreign stocks have experienced slightly higher volatility than U.S. stocks. Thus, it seems counterintuitive that adding foreign exposure to U.S. holdings actually lessens portfolio risk. However, that is the case, again thanks to the fact that U.S. and foreign stocks tend to perform differently.

So what’s the optimal allocation? Research suggests that foreign holdings up to 40% of a stock portfolio reduce portfolio volatility and increase risk-adjusted returns for U.S investors. At Truepoint, we recommend a 40% allocation to maximize the overall portfolio benefits.

Markets Reward Patience

Recent foreign stock performance is simply the current example of the short-term frustration inherent in any well-constructed portfolio. Inevitably, the continued strong run for U.S. stocks will tempt some investors to discard the time-tested principles of diversification. The willingness to abandon the discipline of diversification largely occurs for one of two reasons: increased greed or increased fear.

As important as it is for investors not to panic out of an asset class after a large decline, it is equally important not to panic into an asset class after a large rally. No asset class will be the best performer in all times and, despite the constant efforts of many, no one has shown the ability to know ahead of time which asset class will perform best. So regardless of what 2015 may hold, long-term investors will be rewarded for sticking to a plan rather than focusing on the temporarily strong or weak performance of any one asset class.