Q1 2016 in Review: How Discipline Helped Investors Overcome Turbulence

So far, 2016 has been one for the record books. The market, perhaps chagrined from a relatively uneventful performance last year, seemed determined to add some excitement for investors. And, it delivered: setting records for the worst four-day, one-week and ten-day start to a calendar year in market history!

Indeed, the first half of the quarter began with the S&P 500 Index falling more than 10%, prompting Truepoint to send a reassuring communication on February 12 entitled, “The Rollercoaster Start to 2016.” Not long after reaching everyone’s inbox, the S&P 500 sharply reversed course and rose more than 12% over an uninterrupted, six-week rally.

At the close of the quarter, headlines at CNBC read: “Dow posts Biggest Quarterly Comeback since 1933” – another record!

Volatility – Friend or Foe?

Despite extraordinary intra-quarter movements, a typical 70/30 (stock/bond) portfolio earned just under 2% for the quarter. But a strong March performance serves as a healthy reminder: disciplined investors adhering to a systematic rebalancing strategy were rewarded by capturing the market’s best quarterly comeback since 1933.

True to Truepoint’s investment philosophy, we’ve been diligently rebalancing client portfolios as the market decline provided unique buying opportunities – particularly in emerging markets. Of course, we had no way of knowing when the discipline of this activity would be rewarded, but history and experience told us that it would be rewarded. If the last six weeks of the quarter are any indication, these purchases should be great long-term investments as emerging markets rallied 22% from the intra-quarter lows.

While the logic of opportunistic rebalancing is clear (buying low and selling high), disciplined execution is rare among investors because of the psychological challenges it poses. For example, buying stocks in the midst of the dot-com bubble crash or the financial crisis of 2008 was uncomfortable, to say the least. However, the short-term comfort generated by avoiding stocks during those periods came at a high price. Never was this more evident than in the recovery of 2009 as stocks surged nearly 70% while record levels of cash holdings collected dust on the sidelines.

Diversification Results in Leaders and Laggards

We often advise against holding concentrated stock positions or having too much exposure to a particular region – but why? The answer: uncertainty. Because we don’t know which asset will perform best in any given time period, we hold a portfolio of assets that perform differently during periods of volatility. When some assets perform better than others, this enables us to opportunistically rebalance portfolios.

This makes sense in theory, but it’s often challenging for investors to implement a diversified strategy over time. There will always be a number of asset classes that are underperforming and investors are often tempted to “sell the losers.” The past few years are a great example of a diversified portfolio significantly underperforming U.S. large capitalization stocks (S&P 500). In fact, a diversified portfolio will always underperform the best performing asset in the portfolio simply because other assets in the portfolio didn’t perform as well. But, as mentioned earlier, there’s no guarantee that U.S. large capitalization stocks will continue to outperform other asset classes.

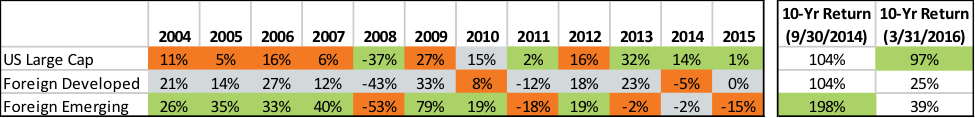

The following table illustrates this concept. We need only go back to September 30, 2014 to completely reverse the outperformance of 10-year returns between U.S. large capitalization stocks (S&P 500) and foreign emerging markets.

Discipline Points the Way Forward

This past quarter demonstrates the importance of a disciplined and systematic investment process. If an investor holds a broadly diversified portfolio, maintains an appropriate asset allocation, and opportunistically rebalances between asset classes, any storm can be weathered. While the ups and downs of the first quarter may have been nerve-wracking, these seemingly extreme events do, in fact, fall within the range of near-term expected outcomes.

Regardless of what the rest of 2016 may hold, long-term investors will be rewarded for maintaining discipline rather than focusing on temporarily strong or weak performance of any particular asset class.