Worried about Brexit? Best to Keep Context in Mind

As of a few weeks ago, investors were hoping for a quiet finish to an uneventful quarter so they could ease into their summer vacations. But then, voters in the United Kingdom (U.K.) cast their votes on how this quarter would end. As you know, global markets responded negatively to the U.K.’s vote to exit the European Union (EU), prompting us to email our initial thoughts on “What Brexit Means to You” the day after the vote. While global markets were clearly surprised by the results of the referendum, for long-term investors, it will likely prove to be another short-term aberration.

The second quarter started out strong as both foreign and domestic stocks surged into positive return territory. As the quarter progressed, foreign stocks lost some of their luster, but by mid-June it looked as though the quarter would finish with slightly positive gains for stocks and bonds. In the two trading days following Brexit, markets dropped sharply with the S&P 500 down 5.3%, emerging markets down 7.3%, and foreign developed markets down 10.0%.

Then, after two days of digesting the news, markets roared back, erasing nearly all the post-Brexit losses in domestic and emerging markets. While foreign developed markets have not completely recovered, they have rebounded sharply and prices are essentially unchanged for the quarter.

Historical Market Trends: Recovery Follows Turbulence

Brexit is not the first unexpected market shock since the depths of the financial crisis. You may recall a few:

- The BP oil spill in 2010 that triggered concerns about a permanent environmental disaster

- The Japanese earthquake in 2011 which seemed to signal a nuclear disaster with global implications

- The U.S. debt ceiling debacle in 2011

- The first round of European debt fears in 2012

- Fears of a global Ebola outbreak in 2014

These largely unexpected events all triggered significant market declines. However, all of the losses from these events were recovered within six months. And of course, none of the doomsday scenarios actually materialized.

[table id=10 /]

The recurring pattern here suggests a common thread underlying event-driven market pullbacks, including the most recent one caused by Brexit. While each of these events raised valid economic concerns, it’s also worth considering their impact in light of the 2008 financial crisis and its effect on investor psychology. To borrow a term, some investors remain “shell-shocked,” and are quick to retreat in the face of new economic concerns, despite strong market returns since 2008. This sentiment demonstrates how traumatic experiences, like the financial crisis, powerfully influence human behavior.

After the Dramatic Vote, Slow and Complex Negotiations to Follow

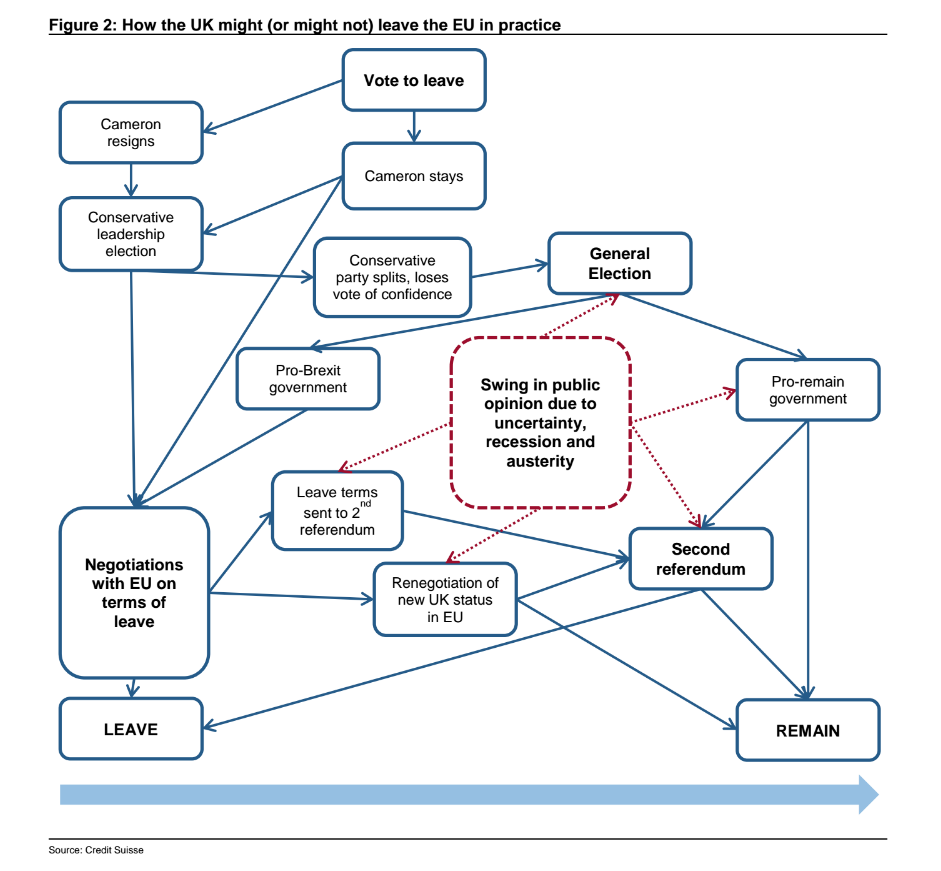

In considering the aftermath of the Brexit, we must assess whether the impacts will be mitigated through new trade agreements, monetary policy adjustments or other actions. Keep in mind that the referendum vote is non-binding and will likely be the start of a complicated and drawn-out negotiation process. Just look at the decision tree below; there’s simply no way to accurately predict the outcomes or impacts.

Looking ahead, it’s in the interests of all parties that the Brexit negotiations proceed smoothly. Regardless of the path forward, however, short-term economic disruptions are likely unavoidable. That said, investors should keep in mind that stock market returns and economic growth often move in opposite directions.

Further, they should recall how dark and dangerous the BP oil spill, U.S. debt ceiling debates and other crises-of-the-moment seemed before they faded from the headlines. While we are sympathetic to investor emotions, our job as advisors is to keep clients from derailing their long-term financial plans. Truepoint’s approach in all of these situations has been consistent – we use periods of heightened volatility as opportunities to buy assets at lower prices and rebalance client portfolios. To paraphrase Jason Zweig of The Wall Street Journal, the ability to withstand and capitalize on these shocks is what separates great investors from everyone else.